ESG Risk Management

The Company has introduced and effectively operates a corporate risk management system (CRMS), which is integrated into the key business and management processes of the Company and is aimed at achieving an optimal balance between KMG’s value growth, its profitability and risks. Risk management in the Company allows preventing the occurrence of risk events affecting the achievement of strategic and operational objectives and limiting their impact when they occur.

The CRMS is a key component of KMG’s corporate governance system, with a vertical risk management process built at all management levels and aimed at timely identification, assessment and monitoring of all material risks, as well as taking timely and adequate actions to mitigate risks.

The Board of Directors, supported by the Audit Committee of the Board of Directors, determines the main vector of risk management development to provide assurance of compliance with the Company’s strategic goals, timely identification of the Company’s key risks, their assessment and management methods, and reviews reports on the effectiveness of the risk management system.

The Management Board is responsible for the organisation and effective functioning of the CRMS, timely submission of quarterly risk reports to the Fund, the Audit Committee and the Board of Directors, ensuring implementation of the CRMS Policy, improvement of internal regulatory documents in the field of risk management of the Company and taking necessary risk management actions. The Management Board has a Risk Committee, which is a permanent consultative and advisory body established for preliminary consideration of KMG Group’s risk management issues and preparation of recommendations to the KMG Management Board for decision-making. The Committee considers the Company’s risks and the effectiveness of activities to manage them, methodological documents on risk management, proposals for the development of risk management policies, procedures and structure; new approaches to risk management, and work plans to improve the CRMS.

In accordance with the concept of three lines of defence at KMG, the first line of defence (business functions) – managers and employees of structural divisions – is responsible for risk assessment and management at their level, as well as for ensuring an effective internal control system; the second line of defence (monitoring functions) – managers and employees of structural units – is responsible for ensuring and monitoring the implementation of effective risk management practices, internal control, compliance with legislation, internal documents and investigation of unfair practices on the part of KMG’s employees; and the third line of defence (independent function) – Internal Audit Service – provides confirmation to the Board of Directors and KMG’s Management Board on the effectiveness of the management systems and operation of the first and second lines of defence.

Identification of risks/risk factors inherent in KMG Group’s activities, the occurrence of which may adversely affect the ability to achieve the planned goals and realise the set objectives, assessment and development of an action plan for their management is carried out by the owners of risks/risk factors at all management levels. In 2023, the Company updated the consolidated Risk Register, including risks affecting the sustainable development of KMG Group.

Key ESG risks and actions taken to manage and mitigate them

|

Trend (over the year) |

Risk description and possible consequences |

Actions taken to mitigate and manage risk |

|

Environmental aspects |

||

|

Climate risks and low-carbon development In its activities, the Company faces risks associated with energy transition and climate change, which include the following risk factors:

Impact These risks may adversely affect the Company’s business as a major fossil fuel producer and greenhouse gas emitter by increasing costs, reducing profitability and limiting opportunities for further development. In certain counterparty countries, an increase in the production of energy from renewable sources can be expected, which may lead to a decrease in the consumption of products supplied by the Company. |

As part of minimising the risk associated with climate change and its consequences, KMG Group has been taking the following actions:

|

|

|

Risk of adverse environmental impact The Company is exposed to the risk of adverse environmental impact and the risk of stricter liabilities for non-compliance with environmental legislation. Impact The realisation of environmental risk may entail financial costs in the form of fines, excessive payments, environmental remediation costs, as well as statutory liability and increased social and environmental tension. |

In the field of environmental protection, the Company’s priority areas of focus are:

To minimise the risk of adverse environmental impact, the Company implements:

|

|

|

Oil spill risk from offshore operations Disturbances of process conditions, pipeline accidents, abnormal operation of production and process equipment, gas and oil spills during drilling of exploration and appraisal wells, as well as the closed ecosystem of the Caspian Sea, shallow water, abnormally high formation pressure in the field, the presence of high hydrogen sulphide content and seasonal freezing of the surface may lead to oil spills. Impact These factors may result in significant environmental damage, shutdown of the production process and financial costs to eliminate the accident and its consequences. |

In order to minimise the risk of oil spills, the Company takes the following actions:

|

|

|

Risk of emergencies and man-made disasters at industrial facilities The Company’s operations are potentially hazardous. There is a risk of damage to property, third parties and the environment as a result of accidents, emergencies and man-made disasters at industrial facilities. In the reporting period, an accident was registered in the oil and gas production department of Embamunaigas JSC: on 16 November 2023, a gas, oil and water inflow occurred during the drilling process while extracting core from the well. There were no casualties. Impact Industrial accidents can lead to the following consequences:

|

The following preventive actions are taken to prevent incidents during drilling operations:

In order to minimise industrial risks, the Company implements:

Voluntary property insurance contracts are concluded annually against damage (risk of accidental loss, loss or damage) as a result of an insured event. |

|

|

Social aspect |

||

|

Risk of occupational injuries Failure of employees to comply with the established OHS rules, violation of production discipline is a source of threat to life and damage to health of employees. By the end of 2023, 29 employees of KMG Group suffered injuries, compared to 2022; there is a 19 % decrease. Due to the increase in lost time accidents involving contractors in 2023, actions are being taken to improve contractor liaison processes to minimise HSE risks. Impact Failure to comply with OHS rules may result in personal injury, as well as production disruption, financial losses and damage to the Company’s business reputation. For more information, see the Health, Safety and Environment section. |

In order to prevent occupational accidents, the Company takes organisational and technical activities to ensure:

|

|

|

Pandemic risk The emergence of new viruses/ strains poses a threat to worker health. The epidemiological situation in the Republic of Kazakhstan regarding the incidence of coronavirus infection (CVI) is relatively favourable, with a decrease in the incidence of the disease. In May 2023, the World Health Organisation cancelled the status of “public health emergency of international concern” for COVID-19. However, this does not mean that the virus is no longer a threat. Impact

|

Depending on the current epidemiological situation and the epidemiological risk zone in a particular region, the corporate centre and subsidiaries and affiliates comply with the requirements and recommendations of the current resolutions of the chief state sanitary doctors. A set of actions is taken in accordance with approved algorithms to ensure preparedness and continuity of KMG and its SDEs in case of deterioration of the situation related to the spread of new strains. |

|

|

Terrorism risk Terrorist and other violent actions against the Company’s personnel, contractors and assets. Impact The Company operates in a number of countries where terrorist acts and other criminal attacks against the Company’s assets are likely to occur. In the reporting period, no facts of realisation of this risk in KMG Group were identified. |

The Company implements a set of preventive actions, including:

|

|

|

Social situation in the regions of operations The Company is exposed to the risk of unauthorised industrial action. Impact Negative impact on the Company’s reputation, resulting in disruption to operations and higher operating costs, and impact on capital expenditure and project schedules. Higher commodity prices, higher domestic inflation or the continued weakening of the tenge could impact negotiations over pay changes. During 2023, there were a number of unauthorised strikes amongst contractor employees and some employees of SDEs. Negotiations with leaders of trade union committees and meetings with employees were held, as well as actions were taken to reduce the wage gap between the Company’s employees and contractors. At the end of 2023, the number of strikes in KMG SDEs and their contractors decreased by 59 % in Mangistau Region (9 strikes in 2023 compared to 22 strikes in 2022). |

To mitigate social risks, the Company takes the following actions.

|

|

|

Corporate governance aspects |

||

|

Compliance risks Deliberate actions of corruption aimed at obtaining personal benefit and property interests, including for third parties. Any facts of corruption are absolutely unacceptable in the Company’s activities, regardless of the amount of financial damage. Impact Financial loss, damage to reputation. |

The Company carries out consistent work to introduce and strengthen compliance control systems, to establish a unified policy to prevent unlawful and unfair acts of both third parties and the Company’s employees, to establish a procedure for internal investigations of unlawful and unfair acts of employees. The Company has policies and standards in place, taking into account the world’s leading practices, as well as commitments to:

|

|

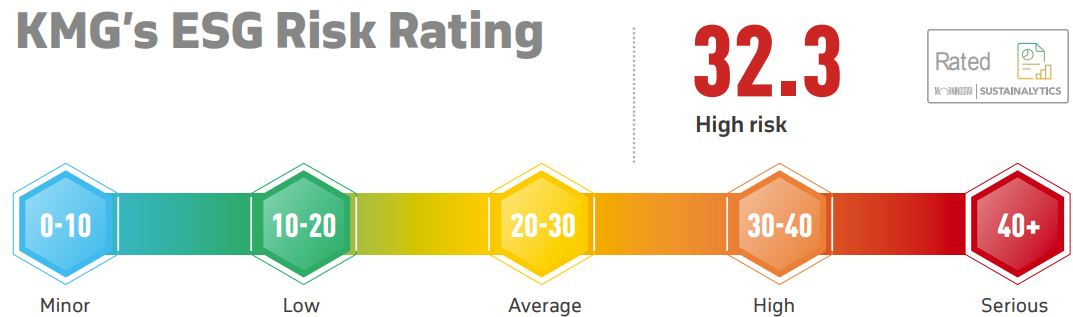

Sustainalytics conducted an annual comprehensive analysis of the environmental, social policy and corporate governance (ESG) performance of NC KazMunayGas JSC.

KMG’s ESG risk management was rated by the rating agency at the level of 32.3 points, while the rating was previously 28.5 points.

In the comparative ranking, KMG moved from 18th place to 40th among 315 global oil and gas companies assessed by Sustainalytics.

According to analysts, the high value of ESG risk exposure rating corresponds to the average values for the industry, i.e. risks inherent to the oil and gas industry. The score reflects the ESG risks faced by the Company in terms of emissions and waste volumes, operational safety performance and corporate governance issues.

At the same time, KMG received a positive expert assessment on risk management on anti-corruption issues, increased the level of risk management on human capital issues, and maintained a stable level of risk management on resource utilisation, biodiversity and business ethics.

KMG recognises the importance of strengthening actions and works on ESG aspects. The key ESG challenges for KMG are reducing emissions, waste, continuing the implementation of the Low-Carbon Development Programme, strengthening work on health and safety of employees, as well as supporting the corporate governance system at the level of international best practice.

Sustainalytics gives ESG rating to the companies by assessing their environmental, social responsibility and governance risks, and their capability to manage such risks as compared to competitors. More detailed information about Sustainalytics rating is available at:

https://www.sustainalytics.com/esg-rating/national-company-kazmunaygas-jsc/1028382256.

Sustainalytics International Rating Agency (Amsterdam, Netherlands)

Sustainalytics is a leading independent company engaged in environmental, social and corporate governance research, ratings and analysis, supporting investors around the world in development and implementation of responsible investment strategies.

For reference

ESG Rating (Environmental, Social and Governance) is an the ecological and social business risk assessment as well as corporate governance risk assessment in a company.

When making investment decisions, the investors use the ESG Rating as a strategic tool that helps to identify risks and opportunities of a company to define its long-term sustainability.

- ABOUT THE COMPANY

- Company Strategy and Key Results

- Sustainable Development Management