LOW-CARBON DEVELOPMENT

|

Principle 7. Business should support a precautionary approach to environmental issues. |

|

Principle 8. Business should take initiatives to increase environmental responsibility. |

|

Principle 9. Business should promote the development and diffusion of environmentally sound technologies. |

Low-Carbon Policy in the Company

Kazakhstan’s Strategy for Achieving Carbon Neutrality by 2060

Kazakhstan announced a new goal of achieving carbon neutrality by 2060, reaffirming its commitments under the Paris Agreement to prevent global temperature rise of more than 1.5-2oC. In February 2023, the Strategy for Achieving Carbon Neutrality of the Republic of Kazakhstan by 2060 was adopted.

The main goal of the Strategy is to achieve sustainable development of Kazakhstan’s economy to climate change and carbon neutrality by 2060. As a medium-term goal, it is expected to reduce greenhouse gas emissions by 15 % by 2030 relative to 1990 levels and by 25 % subject to international support for decarbonisation of the economy.

This Strategy sets ambitious zero-carbon targets to combat climate change and defines the main technological transformations needed to decarbonise the country. To achieve these transformations, Kazakhstan will need to identify and implement effective and targeted economy-wide policies and programmes.

Update of the 2060 Low-Carbon Development Programme

In accordance with the new Action Plan to improve KMG’s ESG Risk Rating approved by KMG’s Board of Directors on 5 October 2023, the Company is required to develop a 2060 Low-Carbon Development Programme to align it with the Strategy for Achieving Carbon Neutrality by 2060 approved by the Government of the Republic of Kazakhstan in 2023.

The new programme, in accordance with international standards, will set short-, medium- and long-term greenhouse gas emission reduction targets covering all Scopes (1, 2 and 3) and complying with the Paris Agreement. The second step will be to measure and set targets for reducing the Company’s methane emissions. In addition, targets for RES development, energy efficiency and green investments, etc. will be set.

Energy efficiency and energy saving, RES development, introduction of methane management, production of low-carbon products with higher added value, implementation of offset projects, carbon regulation, financing and green investments will be identified as the main KMG areas of the 2060 LCD Programme.

Development of benchmarks for light oil products

In accordance with the Environmental Code of the Republic of Kazakhstan, the allocation of carbon credits is calculated by applying benchmarks approved by Order No. 260 dated 19 July 2021 of the Acting Minister of Ecology, Geology and Natural Resources of the Republic of Kazakhstan. The current benchmark for oil products is based on data that takes into account mostly dark oil products. At the same time, the production of light oil products is technologically more complex, with a large number of stages of product purification and, as a consequence, more energy- and carbon-intensive compared to the production of dark oil products, which is why the three largest refineries producing light oil products – Atyrau Refinery, PetroKazakhstan Oil Products and Pavlodar Oil Chemistry Refinery – annually have to request additional quotas to prove the validity of such a request.

In order to further justify the setting of a fair benchmark and to reduce the quota deficit at KMG’s refineries, work was undertaken to calculate benchmarks for light oil products in 2023. In 2024, it is planned to continue work on harmonising and approving the draft new benchmarks with the Ministry of Ecology and Natural Resources of the Republic of Kazakhstan.

Expanding the coverage of greenhouse gas emissions reporting

In order to improve reporting on greenhouse gases and improve the greenhouse gas emissions management system for KMG Group, work was carried out to inventory indirect greenhouse gas emissions of Scope 3 by 12 categories, and a methodology for collecting information was developed for its subsequent implementation into the Methodology for Monitoring and Reporting of KMG’s Greenhouse Gas Emissions. Previously, KMG disclosed Scope 3 emissions only for category 11 “Use of sold products”. This initiative will lay the foundation for developing a strategy to engage with our suppliers and customers to systematically reduce indirect emissions from KMG’s products.

Internal carbon pricing programme

In December 2022, the Management Board of KMG approved the Internal Carbon Pricing Programme), which describes the international experience in the implementation of the internal carbon pricing mechanism. In international practice, there are three types of internal carbon pricing:

- internal carbon fee – a fixed fee per tonne of carbon emissions for carbon-intensive facilities in order to form a reallocation of investments to finance the company’s efforts to reduce emissions;

- hidden price – the theoretical price that the company is willing to pay to implement low-carbon projects. This price determines the ultimate ceiling of investments for the implementation of low-carbon projects;

- implicit price – involves estimating the cost of a tonne of CO2 toe as part of the cost of reducing greenhouse gas emissions and/or the cost of complying with government regulations.

In accordance with the order of the Chairman of the Management Board of KMG, in 2023, the Working Group for the development of an internal carbon pricing mechanism, which included representatives of all interested units of KMG, developed a mechanism for the application of an implicit carbon price in order to assess the financial costs of KMG from carbon regulation.

In December 2023, the Management Board of KMG approved an updated Internal Carbon Pricing Programme, which discloses the mechanism for determining the amount of implicit price and its application in the consideration of investment projects. The application of internal carbon fee and implicit price mechanisms will be considered in subsequent years.

In addition, we launched a number of initiatives aimed at improving reporting, enhancing the Company’s investment attractiveness and improving international ratings.

Task Force on Climate-related Financial Disclosures

With the support of the European Bank for Reconstruction and Development within the framework of the Memorandum of Cooperation signed in June 2022, a project to implement climate reporting in accordance with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) was implemented in 2023. The project consisted of four stages.

At the first stage “Initial Diagnostics” of the Project implementation, the current practices of KMG’s business processes in the field of decarbonisation and sustainable development were analysed for compliance with the TCFD recommendations. Comparative analysis (benchmarking) was performed to identify and present the best sectoral practices in the field of information disclosure in accordance with TCFD recommendations, including a list of climate risks was identified in order to conduct a deeper scenario analysis of their impact on the business model of KMG in the short- (up to 2030), medium- (up to 2045) and long-term (up to 2060) perspective.

The second stage of the Project “Risk Assessment, Climate Change Scenario, Analyses and Stress Tests” analysed the Company’s value chain to further analyse its relevant segments for exposure to climate risks.

Within each segment of the value chain (production, transportation, refining), including the Company’s foreign assets, 30 strategic assets within 17 SDEs were identified for further scenario analysis. Further scenario analysis was performed for these assets to determine their exposure to climate risks under different scenarios of temperature change and regulation by an authorised body.

Based on the results of the analysis of exposure to climate risks, the financial impact of these risks on the key financial indicators of SDEs and consolidated financial indicators of KMG, such as net profit and EBIDTA margin, was calculated. The Company’s assets and the relevant SDEs were then ranked according to their exposure to the main climate risks. The analysis also took into account energy transition opportunities and related decarbonisation projects planned to be implemented by KMG under the adopted LCD Programme.

During the third stage of the Project, an analysis of KMG’s decarbonisation activities was performed to better understand the Company’s current plans. Based on this analysis, methodological recommendations were provided to quantify the results of the implementation of priority climate change mitigation activities for both ex-ante and ex-post quantification.

Quantitative ex-ante assessments will be used for strategic planning and prioritisation of climate actions to be implemented, while quantitative ex-post assessments will be used for KMG’s climate reporting. The proposed methodologies for quantitative assessment are based on international standards for greenhouse gas accounting, such as the Greenhouse Gas Protocol. Recommendations on revision of targets already set by KMG (GHG emission target for 2031 and low-carbon projections for 2060) are also presented, including analysis of divergence from:

- international standards (e.g. SBTi recommends developing a short-term target for 5-10 years starting from the year of target setting and a long-term target no later than 2050);

- GHG accounting standards (e.g. GHG Protocol), including data boundaries and completeness.

In addition, recommendations are provided on how KMG’s climate targets can be better aligned with international standards (e.g. in relation to the inclusion of Scope 3 emissions as recommended by SBTi). Based on the analysis, recommendations are provided for supplementing the list of decarbonisation activities with additional mitigation and adaptation activities for KMG to meet its climate targets, reduce risks and take advantage of climate opportunities. This list is largely based on the energy and resource conservation activities, as well as implementation/investment in renewable energy sources already identified by KMG.

During the fourth and final stage of the Project, summarising the results of the previous stages and the analysis, an Action Plan for Corporate Climate Governance was developed.

Greenhouse gas emissions

In July 2023, the Carbon Disclosure Project published the 2022 Climate Questionnaire, which includes data on direct and indirect greenhouse gas emissions for all KMG assets, including subsidiaries in Romania and Georgia.

According to the report, KMG Group’s direct carbon dioxide emissions for 2022 amounted to 7.6 mln tonnes of CO2 (8.1 mln tonnes of CO2toe). Data in CO2toe are presented using IPCC Fifth Assessment Report global warming potential factors (methane – 28, nitrous oxide – 265). The calculation includes carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O). The data on direct greenhouse gas emissions are confirmed by the conclusions of independent accredited organisations for each SDE.

Information for 2023 will be disclosed in the CDP report in Q4 2024. We adhere to the principle of consistency and comparability in our disclosures. We are continuously working to improve the completeness of our disclosures.

The CDP Questionnaires are available at: https://www.kmg.kz/en/investors/reporting/

The volume of direct greenhouse gas emissions (CO2) in 2023 for KMG Group amounted to 7.44 mln tonnes of CO2 (8.57 mln tonnes of CO2toe).

|

Scope 1. Direct emissions |

|

2021 |

2022 |

2023 |

|---|---|---|---|---|

|

Breakdown by business area |

|

|

|

|

|

Production |

mln tonnes of CO2/ mln tonnes of CO2toe |

2.2/4.3 |

2.4/2.8 |

2.33/3.44 |

|

Refining |

mln tonnes of CO2/ mln tonnes of CO2toe |

4.5/6.1 |

5.1/5.2 |

5.01/5.03 |

|

Transportation |

mln tonnes of CO2/ mln tonnes of CO2toe |

0.2/0.2 |

0.1/0.1 |

0.1/0.1 |

|

Breakdown by country |

|

|

|

|

|

Kazakhstan |

mln tonnes of CO2/ mln tonnes of CO2toe |

6.2/9.9 |

6.6/7.1 |

6.55/7.68 |

|

Romania |

mln tonnes of CO2/ mln tonnes of CO2toe |

0.7/0.7 |

0.9/0.9 |

0.88/0.88 |

|

Georgia |

mln tonnes of CO2/ mln tonnes of CO2toe |

0.01/0.01 |

0.02/0.02 |

0.02/0.02 |

|

Breakdown of emissions by greenhouse gas type |

|

|

|

|

|

СО2 |

mln tonnes СО2 |

6.9 |

7.6 |

7.44 |

|

CH4 |

mln tonnes СО2toe |

3.2 |

0.4 |

1.11 |

|

N2O |

mln tonnes СО2toe |

0.5 |

0.1 |

0.02 |

|

Scope 2. Indirect emissions (market-based method) |

mln tonnes of CO2/ mln tonnes of CO2toe |

3.3/3.3 |

3.2/3.2 |

Information for 2023 will be disclosed in the CDP report in Q4 2024 |

|

Scope 2. Indirect emissions (location-based method) |

mln tonnes of CO2/ mln tonnes of CO2toe |

3.3/3.3 |

3.3/3.3 |

|

|

Scope 3. From use of sold products |

mln tonnes of CO2/ mln tonnes of CO2toe |

61.9/62.1 |

61.6/61.8 |

СО2 EMISSION RATE(tonnes per 1,000 tonnes of HCs produced)

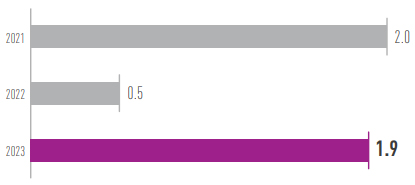

CH4 EMISSION RATE(tonnes per 1,000 tonnes of HCs produced)

The CO2 intensity rate was 114 tonnes of CO2 per 1,000 tonnes of hydrocarbons produced, 3 % below the International Association of Oil and Gas Producers (IOGP) industry average of 116.

The intensity of CO2 emissions to HCS production remained unchanged from last year.

A significant increase in CH4 emission intensity compared to 2022 is due to a change in the methodology for calculating methane emissions at the national level. By order of the Minister of Ecology and Natural Resources of the Republic of Kazakhstan on 18.03.2024, additions and changes to the existing methodology for calculating greenhouse gas emissions were adopted, including increases in applied emission factors for methane.

In its operations, the Company does not emit ozone-depleting substances that affect climate change. Periodic control and monitoring are carried out.

Environmental Indicators

|

Production |

Transportation |

Refining |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

2021 |

2022 |

2023 |

2021 |

2022 |

2023 |

2021 |

2022 |

2023 |

|

|

Greenhouse gas (GHG) emissions |

|

|

|

|

|

|

|

|

|

|

Direct GHG emissions (CO2, mln tonnes) |

2.2 |

2.4 |

2.3 |

0.2 |

0.1 |

0.1 |

4.5 |

5.1 |

5.01 |

|

GHG emission intensity (tonnes of CO2 per 1,000 tonnes of HCs) |

102 |

114 |

114 |

|

|

|

226 |

236 |

238 |

|

APG flaring |

|

|

|

– |

– |

|

– |

– |

|

|

Flaring (mln tonnes of CO2) |

0.11 |

0.09 |

0.08 |

– |

– |

|

– |

– |

|

|

Intensity of associated gas flaring (tonnes per 1000 tonnes of hydrocarbons produced) |

2.1 |

1.5 |

1.4 |

– |

– |

|

– |

– |

|

|

Flaring (mln m3) |

52.5 |

35.7 |

33.3 |

– |

– |

|

– |

– |

|